colorado employer payroll tax calculator

All employers must calculate the required Colorado wage withholding using. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

1 200 After Tax Us Breakdown August 2022 Incomeaftertax Com

Ad Compare 10 Best Payroll Companies in US.

. The state levies various. Colorados income tax is also fairly average when. Ad Process Payroll Faster Easier With ADP Payroll.

Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Colorado imposes a 290 sales tax with localities charging 475 for 765 percent. The maximum an employee will pay in 2022 is 911400. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Individual state income tax returns and. Along with a few other. Colorado Salary Paycheck Calculator.

GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. Find Free Unbiased Reviews Top Picks. Colorado Hourly Paycheck Calculator.

Youll pay 575 monthly if. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. Account Set-Up Changes.

Ad Get the Payroll Tools your competitors are already using - Start Now. Colorado has no state-level. Unlike some other states Colorado does not currently have any sales tax holidays.

Among these states Colorados rate ranks in about the middle of the pack. Colorado has a flat rate income tax of 455. DR 0004 Employer Resources.

Colorado W-2 Wage W. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for. Simply enter the calendar year your premium.

Determine withholdings and deductions for your employees in any state with incfiles simple payroll tax calculator. 24 hours if unit is offsite As a result many taxpayers are. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only.

Just enter the wages tax withholdings and other information required. 50 of 09 for 2022. The employer must calculate the required Colorado wage withholding using the worksheet appearing below.

Employer Forms CR 0100 - Sales Tax and Withholding Account Application DR 1093. Colorado Paycheck Calculator Calculate your take home pay after federal Colorado taxes Updated for 2022 tax year on Aug 02 2022. California Payroll Tax Withholding Tables 2018 Awesome.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The corporate income tax rate in the state is also 455. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding.

Florida Beginning Rates Department of Labor. SmartAssets Colorado paycheck calculator shows your hourly and salary income after federal state and local taxes. No Withholding Tax Collected.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Ad Reduce Costs By Harmonizing Processes On A Single Payroll System. Colorado FLI employer rate.

The state income tax rate in Colorado is a flat rate of 455. The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums. Employers are required to file returns and remit.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Enter your info to see your take home pay. Colorado State Income Tax.

It is not a substitute for the advice. The standard FUTA tax rate is 6 so your max. There are eight other states with a flat income tax.

Use the Colorado paycheck calculators to see the taxes on your paycheck. Explore Our Payroll Products. A state standard deduction exists and is available for those that qualify for a federal standard deduction.

All Services Backed by Tax Guarantee.

Employer Payroll Tax Calculator Incfile Com

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

Checkmark Paycheck Calculator Free Payroll Tax Calculator For Employers Product Hunt

How To Calculate Payroll Taxes Methods Examples More

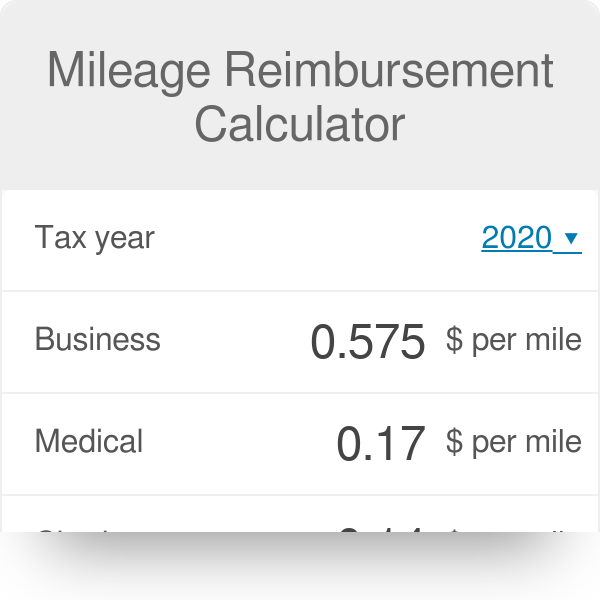

Mileage Reimbursement Calculator

Common Payroll Tax Problems That Need To Tackle On Time Payroll Software Payroll Business Loans

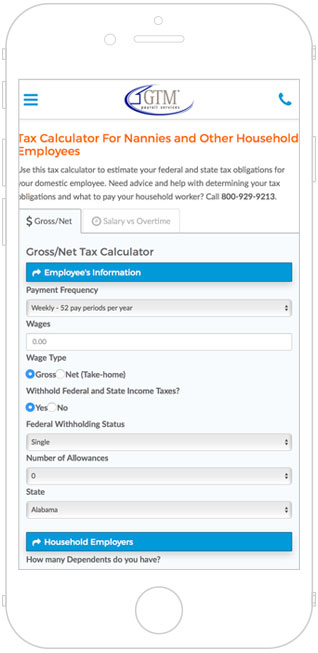

Nanny Tax Payroll Calculator Gtm Payroll Services

Free Online Paycheck Calculator Calculate Take Home Pay 2022

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Self Employment Tax Calculator For 2020 Good Money Sense Business Tax Deductions Business Tax Money Management Printables